NY SCRIE Adjust to Abate 2011-2026 free printable template

Show details

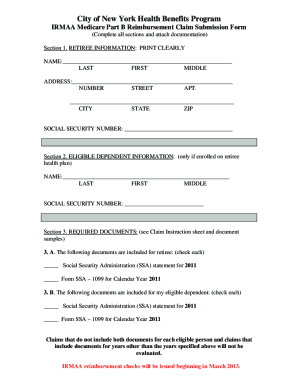

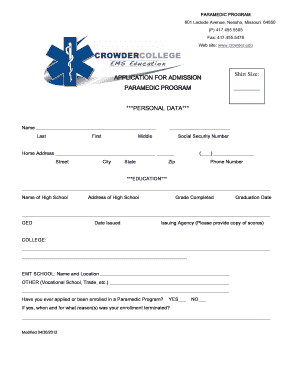

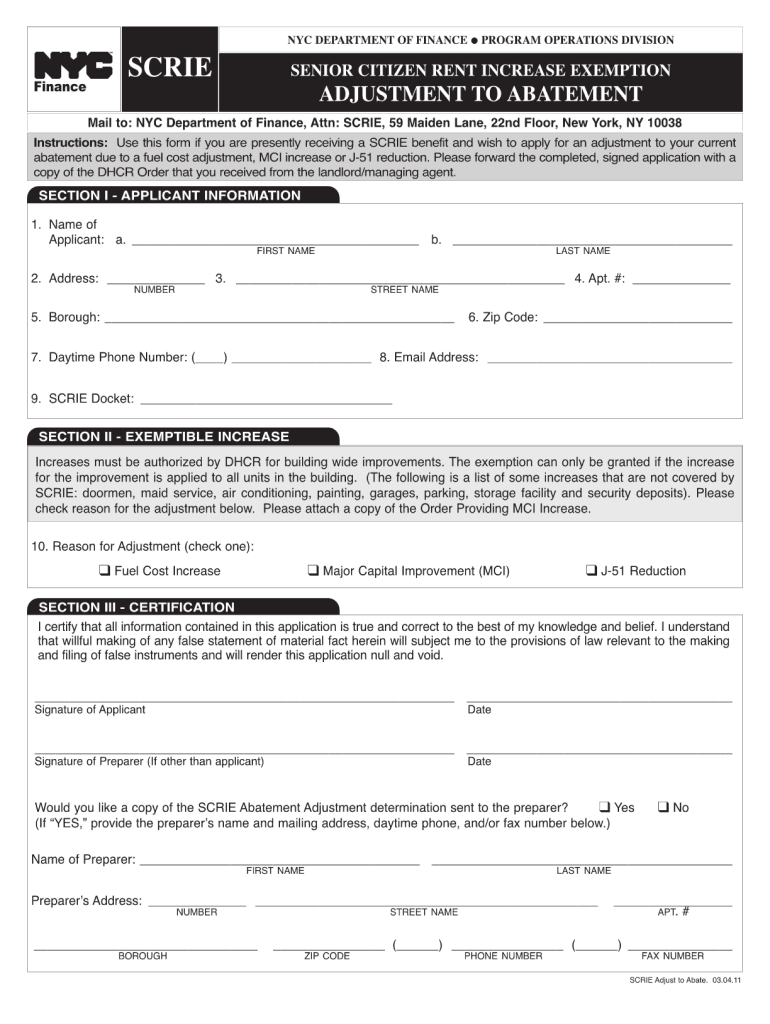

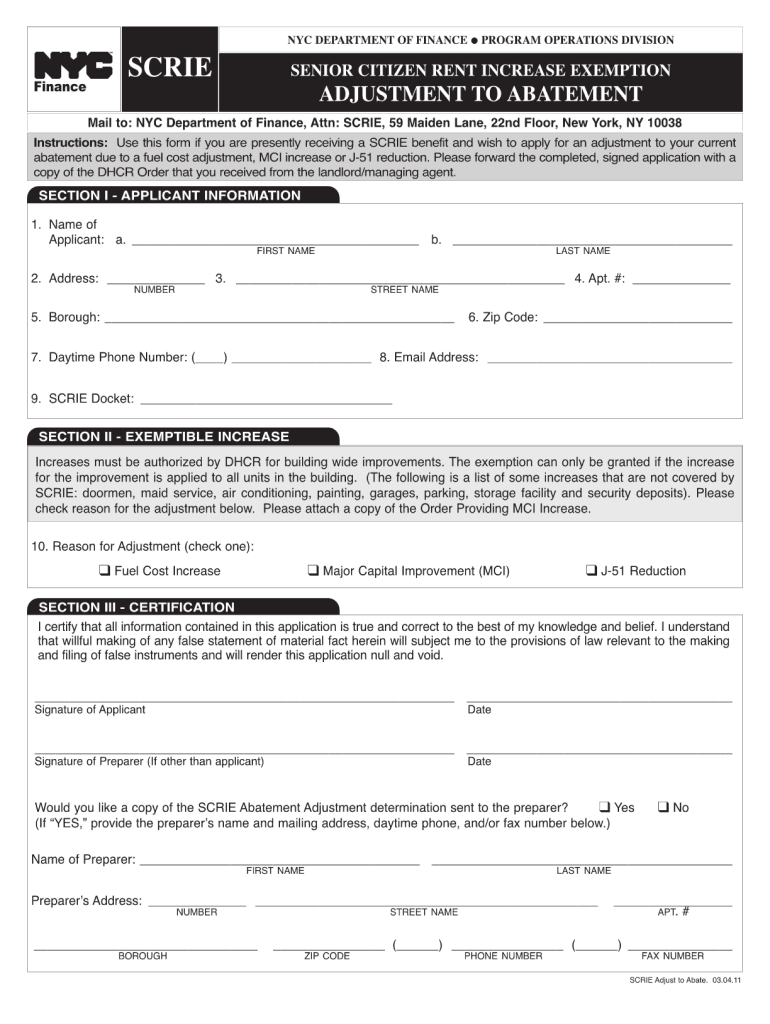

TM Finance Instructions: Use this form if you are presently receiving a SCRIBE benefit and wish to apply for an adjustment to your current abatement due to a fuel cost adjustment, MCI increase or

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign scrie application status form

Edit your scrie renewal application 2025 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your adjustment abatement form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit scrie renewal application status online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit scrie appeal form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out scrie tac report 2025 form

How to fill out NY SCRIE Adjust to Abate

01

Gather necessary documents: Collect your proof of income, rent receipts, and any other relevant financial information.

02

Obtain the NY SCRIE application form: You can download it from the official NYC Department of Finance website or request a copy from your local office.

03

Complete the application form: Fill out all required fields, ensuring accuracy and completeness.

04

Attach supporting documentation: Include copies of your income proof, rent receipts, and any other documentation required by the form.

05

Submit the application: Send your completed application and documentation to the appropriate address provided on the form.

06

Follow up: After submitting your application, check the status of your application with the local office to ensure it is being processed.

Who needs NY SCRIE Adjust to Abate?

01

Senior citizens aged 62 or older who are rent-burdened and living in rent-regulated apartments.

02

Individuals who meet the income requirements set by New York City for the SCRIE program.

03

Renters who need financial assistance to maintain their housing stability due to rising rents.

Fill

scrie status

: Try Risk Free

People Also Ask about scrie renewal application

Who is eligible for rent freeze in NYC?

You may qualify for the NYC Rent Freeze Program if you meet both of these requirements: Rent an apartment that is rent regulated (rent controlled, rent stabilized, hotel stabilized or Mitchell-Lama) and; You are a senior citizen or have a disability.

What is the income limit for SCRIE in NYC?

Eligibility Criteria Have a combpined household income for all members of the household that is $50,000 or less; Spend more than one-third of your monthly household income on rent or maintenance; and. Be at least 62 years old.

What is the SCRIE program in NY?

SCRIE helps eligible senior citizens 62 and older stay in affordable housing by freezing their rent. Tenants can keep paying what they were paying even if their landlord increases the rent. The landlord gets a property tax credit that covers the difference between the new and original rent amount.

What is NYS senior citizen rent increase exemption?

SCRIE helps eligible senior citizens 62 and older stay in affordable housing by freezing their rent. Tenants can keep paying what they were paying even if their landlord increases the rent. The landlord gets a property tax credit that covers the difference between the new and original rent amount.

What is New York disability rent increase exemption?

How it Works. DRIE helps eligible tenants with disabilities stay in affordable housing by freezing their rent. This means tenants can keep paying what they were paying even if the landlord increases the rent. The landlord will get a property tax credit that covers the difference between the new and original rent amount

What is the income limit for Scrie in NYC?

Eligibility Criteria Have a combpined household income for all members of the household that is $50,000 or less; Spend more than one-third of your monthly household income on rent or maintenance; and. Be at least 62 years old.

How do I apply for SCRIE in NYC?

How to Apply. Download and submit the appropriate form from the list below. New applicants: Use the SCRIE initial application. Renewing applicants: Use the SCRIE renewal application or, if you have been in the program for five or more consecutive benefit periods, the short-form renewal application.

What is the Scrie program in NY?

SCRIE helps eligible senior citizens 62 and older stay in affordable housing by freezing their rent. Tenants can keep paying what they were paying even if their landlord increases the rent. The landlord gets a property tax credit that covers the difference between the new and original rent amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify scrie application online without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including scrie application renewal, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I sign the scrie application status login electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your scrie application in minutes.

How do I edit scrie tac report on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign scrie renewal application pdf. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is NY SCRIE Adjust to Abate?

NY SCRIE Adjust to Abate is a program designed to provide tax relief for eligible senior citizens in New York City by adjusting property taxes based on their income and housing costs.

Who is required to file NY SCRIE Adjust to Abate?

Eligible senior citizens who are receiving the Senior Citizen Rent Increase Exemption (SCRIE) and need to adjust their benefits based on changes in income or property taxes are required to file this form.

How to fill out NY SCRIE Adjust to Abate?

To fill out the NY SCRIE Adjust to Abate form, applicants must provide personal information, income details, and property tax statements, ensuring all documentation is accurate and complete before submission.

What is the purpose of NY SCRIE Adjust to Abate?

The purpose of NY SCRIE Adjust to Abate is to help eligible senior citizens manage their housing costs by providing a rent freeze or tax abatement, thereby enhancing their financial stability.

What information must be reported on NY SCRIE Adjust to Abate?

The information that must be reported includes the applicant's name, address, income information, property tax details, and any changes in circumstances affecting eligibility for benefits.

Fill out your NY SCRIE Adjust to Abate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Scrie Renewal is not the form you're looking for?Search for another form here.

Keywords relevant to scrie initial application

Related to scrie renewal form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.